Insurance Software Testing and QA

The complex, high-performance insurance software needs more than basic testing. We go beyond test execution, building automation-first frameworks and ensuring your systems are secure, scalable, and ready for sophisticated insurance workflows.

Get a head start in the insurance industry

In a market shaped by rising customer expectations and constant regulatory shifts, high-quality software becomes a valuable competitive advantage. Insurance application testing services help make your digital products fast, secure, and reliable, allowing you to launch new features with confidence, avoid costly errors, and deliver seamless customer experiences that build trust and loyalty. It’s not just about finding bugs — it’s about getting and staying ahead.

- Superb user experience

- 40% faster releases

- Better system stability

- 50% fewer post-release bugs

- Improved accuracy

When to Go for Insurance Software Testing

You are developing a new insurance software product

You need to follow regulatory compliance requirements

You are upgrading or modernizing core systems

You are dealing with multiple third-party data connections

You want your digital transformation to go smoothly

You need to scale QA and testing operations without hiring

Challenges We Solve With Insurance Testing

Frequent production issues

Insurance software testing services reduce costly post-release bugs that disrupt user experience and damage customer trust.

Long release cycles

Test automation for insurance and continuous testing help insurers speed up development and deliver new features faster.

Dated legacy systems

Insurance quality assurance helps identify weak points in aging infrastructure and supports safer modernization or migration efforts.

Complex system integrations

Insurance QA ensures stable connections across CRMs, payment systems, underwriting engines, and third-party APIs.

Why You Need Insurance Testing and QA Services

Insurance software isn’t simple, and neither is testing it. Complex policy rules, claims workflows, compliance, integrations, and real-time data mean even small changes can cause big issues. That’s why software testing and QA services for insurance must go beyond basic scripts.

Reliable, user-friendly insurance platforms keep customers engaged and satisfied, reducing churn and strengthening brand loyalty in a competitive, service-driven market.

Quality assurance ensures smooth policy management, fast claims, and accurate quotes, making your platform dependable and easy to use at every customer touchpoint.

Testing eliminates system bottlenecks, broken workflows, and data sync issues, helping your teams work faster, smarter, and with fewer disruptions.

It also improves collaboration between departments by ensuring core processes like underwriting, billing, or claims run smoothly across integrated systems.

Catching bugs early cuts expensive post-release fixes and reduces customer support burden, freeing up budget for innovation in software development.

A testing approach that includes automation and reusable test assets increases testing speed and accuracy, delivering long-term value across development cycles.

Security testing helps prevent breaches by identifying vulnerabilities in payment flows, data storage, and third-party integrations.

We ensure your platform aligns with data protection regulations, so customer and policyholder data stays secure, encrypted, and fully compliant.

Insurance Solutions We Test

Underwriting software

We validate complex rules, data inputs, and risk assessment logic to ensure accurate, efficient, and compliant underwriting decisions.

Claim management systems

Our testing covers end-to-end claim workflows, from submission to settlement, to improve speed, accuracy, and customer satisfaction.

Policy administration systems

We ensure stability and accuracy across policy creation, updates, renewals, and cancellations, helping insurers manage large volumes with confidence.

Billing and payment software

We test recurring billing, premium calculations, invoicing, and payment integrations to prevent revenue loss and ensure compliance.

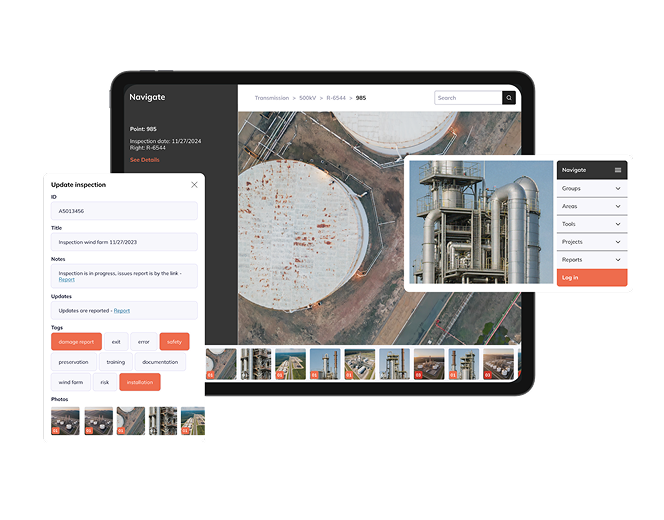

Customer-facing insurance apps

We focus on performance, usability, and responsiveness to create seamless, secure experiences across mobile and web platforms.

Insurance broker portals

Our testing ensures brokers can easily quote, bind, and manage policies with real-time data access and minimal friction.

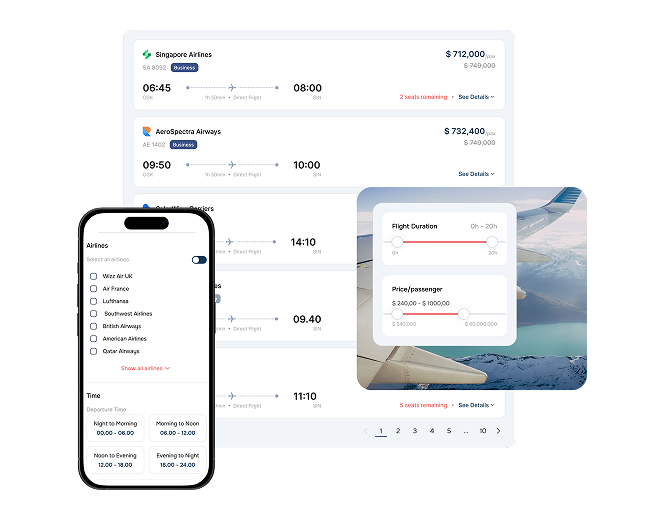

Insurance marketplaces

We validate search, comparison, quote generation, and user account features to facilitate seamless multi-carrier experiences.

Reinsurance management systems

We test complex financial logic, data exchange, and contract workflows to support risk sharing and regulatory reporting.

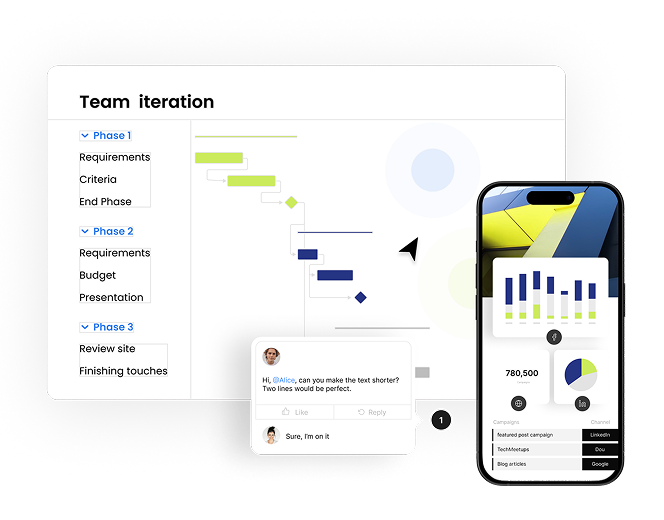

Our Insurance App Testing Process

Requirement

analysis

– Business logic review

– Risk identification

– Scope definition

Test

planning

– Strategy creation

– Tool selection

– Resource allocation

Test

design

– Scenarios creation

– Data planning

– Edge case coverage

Test

execution

– Manual validation

– Automation testing

– Defect reporting

Analysis &

optimization

– Results analysis

– Root cause insights

– Process improvements

Types of Testing for the Insurance Domain

Performance testing

Make sure your systems remain fast, stable, and responsive during peak load or high-traffic periods.

Security testing

Protect sensitive data by identifying vulnerabilities in authentication, encryption, and third-party integrations.

Functional testing

Ensure every single feature of your insurance product works correctly across all user flows.

Automation testing

Accelerate testing and reduce manual effort with scalable, maintainable automated test suites.

Integration testing

Verify stable data exchange between internal systems and third-party services like CRMs and payment gateways.

Compliance testing

Check adherence to industry regulations, privacy laws, and mandatory reporting standards.

Agile & DevOps testing

Support fast, frequent releases by embedding testing into your Agile and CI/CD pipelines.

Data validation testing

Make sure critical insurance data is complete, accurate, and consistent across systems.

Digital transformation testing

Ensure smooth system modernization and legacy migration without disrupting business operations.

Reduce risks, speed up releases, and build software trusted both by businesses and users.

Insurance Companies We Serve

Life insurance providers

We test platforms for policy setup, beneficiary management, and payouts, ensuring long-term reliability and regulatory compliance.

Health insurance companies

Health insurance company software testing ensures smooth claims processing, member portals, and eligibility systems for private, public, and employer-based health plans.

Property coverage firms

We test complex workflows around property valuation, risk assessment, and multi-claim scenarios with integrated geolocation and third-party data.

Auto insurance providers

Car insurance testing services help verify accurate premium calculations, policy customizations, and claims processes for personal, commercial, and usage-based vehicle coverage.

Travel insurance companies

We will ensure your platform supports quick policy issuance, flexible coverage options, and real-time claims for travelers worldwide.

Reinsurance service vendors

We test contract logic, data exchange, and reporting processes that support global risk-sharing and regulatory transparency.

Why TestFort

Extra-mile

approach

We dig deeper, catch what others miss, and adapt to your business, not just your technical requirements.

Full-cycle testing services

Our QA experts design and execute QA strategies that align with your goals, from planning to post-release.

Test automation expertise

We use test automation frameworks that reduce manual effort, speed up releases, and scale with your business.

100% global compliance

We ensure your software meets data protection and reporting regulations for the insurance sector worldwide.