Financial inclusion implies availability and accessibility of financial services to all individuals, regardless of their socioeconomic status, geographic location, or other factors. It is crucial for economic growth and reducing poverty, yet millions of people around the world are still excluded from formal financial systems.

In this article, we will explore how testing can help improve financial inclusion and make financial services more accessible to all. By leveraging testing, banks and other financial institutions can help close the gap in financial inclusion and provide essential services to those who need it most.

How Fintech Increases Financial Inclusion

Financial inclusion has become a critical global issue in recent years, with millions of people around the world lacking access to basic financial services. According to the World Bank, about 1.7 billion adults globally do not have access to a bank account or other financial services, with the majority of them residing in low- and middle-income countries.

Let’s explore how fintech is helping to increase financial inclusion:

Providing access to underserved communities

Fintech companies are bridging the gap between traditional financial institutions and underserved communities. For example, in many low-income neighborhoods, bank branches are few and far between. Fintech companies are providing an alternative through digital banking services that allow people to access their money and financial services fast and on the spot.

Enabling cross-border transactions

Fintech is also making it easier for people to transfer money across borders. Traditional banks have historically charged high fees for international money transfers, which can be prohibitive for low-income individuals and families. Fintech companies are providing more affordable and efficient alternatives.

Developing innovative credit scoring models

One of the biggest barriers to financial inclusion is a lack of credit history or a poor credit score. Fintech companies are developing new credit scoring models that take into account a person’s entire financial history, including their digital footprint, social media activity, and even their utility payments. This enables more people to access credit and other financial services that were previously out of reach.

Offering microfinance solutions

Microfinance is a form of financial services that provides small loans and other financial services to low-income individuals and businesses. Fintech companies are using technology to make microfinance more accessible and affordable. For example, some fintech companies are using blockchain technology to create peer-to-peer lending platforms that allow borrowers and lenders to connect directly, without the need for traditional financial institutions.

Improving access to capital

Fintech can provide new sources of financing for entrepreneurs and businesses that were previously unavailable, such as crowdfunding platforms like Kickstarter or Indiegogo. Additionally, peer-to-peer lending platforms like Lending Club allow people who want some extra cash on hand (or who want their money working harder) to lend directly through an online platform rather than going through banks or other traditional lenders.

Increasing financial literacy

Many fintech companies are also helping to increase financial literacy among underserved communities. Many fintech apps provide educational resources and tools to help people manage their money more effectively. Some fintech companies are even developing financial education apps that use gamification to make learning about personal finance fun and engaging.

Fintech has the potential to revolutionize the way financial services are delivered and increase financial inclusion. However, “having potential” doesn’t always mean being impactful enough.

Why Fintech and Banking Apps are not Inclusive Enough

The lack of financial inclusion is caused by various factors, including high transaction costs, inadequate infrastructure, limited access to financial education, and discrimination against marginalized groups. These challenges prevent people from accessing basic financial services such as savings accounts, loans, and insurance, which are essential for economic stability and growth.

Here is how oversight in fintech and banking solutions development and testings contributes to a problem:

Bias in the development process

Fintech and banking apps are typically designed and developed by teams of individuals who may not have a diverse range of perspectives and experiences. This can lead to the unintentional exclusion of certain groups of users.

Our team was once assigned the task of co-developing and providing comprehensive QA for a finance app that adhered to Sharia law. This involved addressing religious norms in our QA and development work, which was a new experience for us. However, by maintaining an open-minded approach and seeking input from knowledgeable target audience and consultants, we were able to successfully launch an inclusive app that catered to individuals who follow Sharia law as a daily practice.

Lack of diversity in user research

Fintech and banking apps may not be inclusive because they fail to adequately consider the needs and preferences of all potential users. This can happen when user research is not conducted with a diverse group of participants.

Unintuitive design

Fintech and banking apps may be difficult to use for certain groups of users because they are not designed with their needs and preferences in mind. This can be particularly true for older users or users with disabilities.

Limited access to technology

Many of those who could benefit from fintech and banking apps may not have access to the necessary technology. This can include individuals living in rural areas with limited internet access, or those who cannot afford the necessary devices.

Lack of trust

Some individuals may be hesitant to use fintech and banking apps due to concerns about security and privacy. This can be particularly true for older individuals who may be less familiar with these technologies.

How Non-Inclusive Fintech and Banking Apps Fail Millions

The emergence of fintech has revolutionized the financial industry, providing access to a range of financial services that were once out of reach for many. However, not all fintech and banking apps are created equal, and a lack of focus on inclusion and accessibility can have devastating consequences for millions of people.

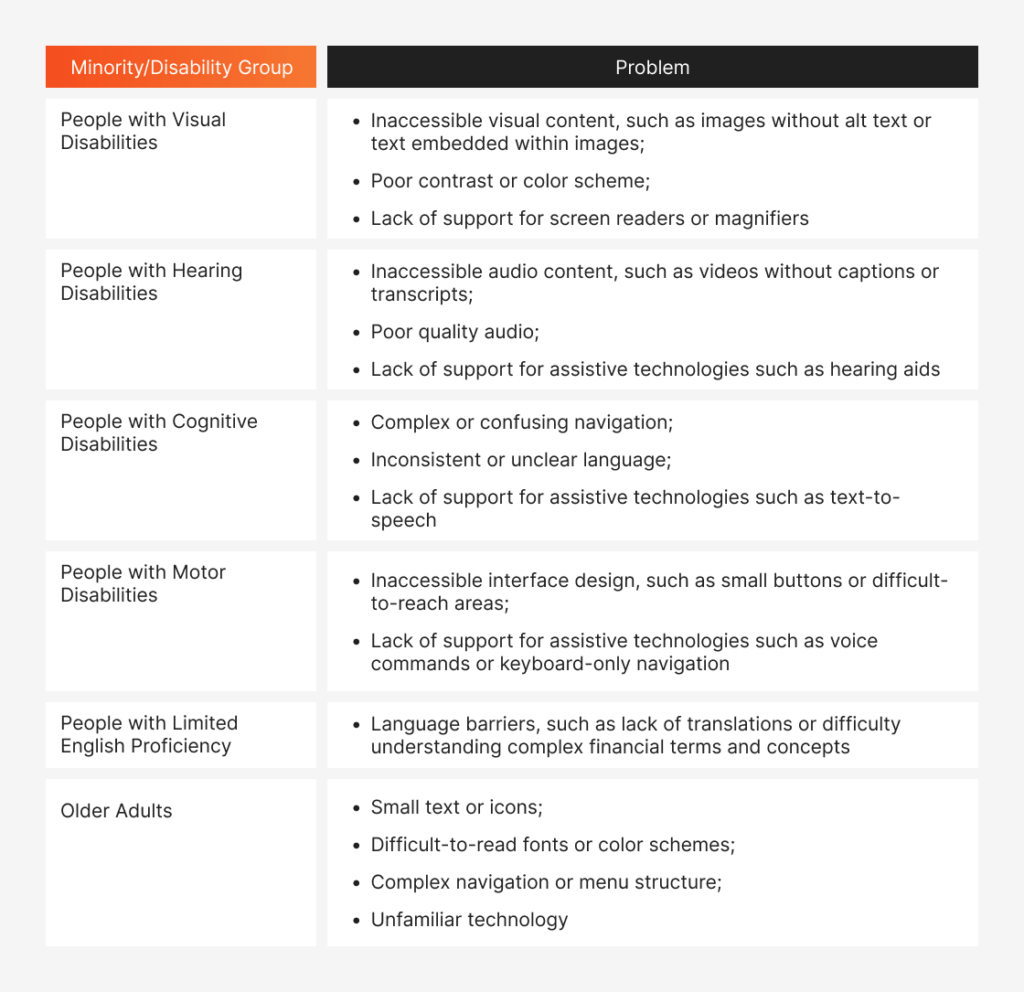

Non-inclusive app design can lock out entire communities, preventing them from accessing basic financial services and exacerbating economic inequality. In this section, we’ll explore the key ways that non-inclusive fintech and banking app design fails millions.

This is not an exhaustive list, and different users may face different challenges. Additionally, many users may have multiple disabilities or belong to multiple minority groups, compounding the challenges they face.

Testing plays a critical role in identifying and addressing barriers to financial inclusion, ensuring that financial services are designed to be user-friendly, accessible, and inclusive.

Real-Life Cases: How Testing Improves Inclusion

Financial inclusion has long been a challenge for many countries, particularly in developing regions. However, with the rise of fintech, there has been a significant shift in the financial landscape. Through the use of innovative technologies, fintech companies are able to reach previously unbanked populations and provide them with access to financial services.

Testing plays a crucial role in ensuring the success of these initiatives, as seen with the examples of M-PESA in Kenya and Janhan Yojana in India:

M-PESA, a mobile service launched in Kenya in 2007, is one of the most successful examples of testing in financial inclusion. Before its launch, the service underwent extensive user testing to ensure that it was easy to use and accessible to the previously unbanked population. The team behind M-PESA conducted usability and accessibility tests to identify and address any barriers to entry. As a result, M-PESA became hugely popular in Kenya and is now used by over 40% of the country’s adult population.

India’s Jan-Dhan Yojana is another successful initiative that made use of testing in financial inclusion. The program aimed to provide financial services to the unbanked population in rural areas of India. Before its launch, the government conducted extensive testing to ensure that the program’s technology and processes were accessible and user-friendly. The testing revealed that the program needed to be simplified and made more accessible, leading to changes that helped make the program successful.

In both cases, testing played a crucial role in the success of these initiatives. By identifying and addressing accessibility and usability issues, the teams behind M-PESA and Jan-Dhan Yojana were able to create financial products and services that were easy to use and accessible to the financially excluded. As a result, these initiatives have helped millions to gain access to financial services, improving financial inclusion in their respective countries.

Let your product’s quality go from good to great!

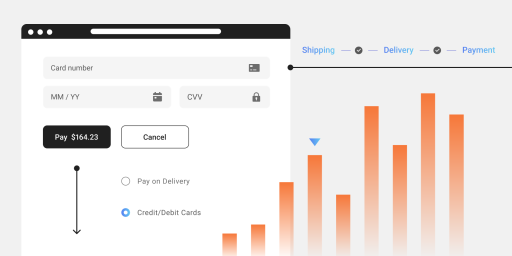

Steps to Improve Inclusion via QA for Fintech Apps

The benefits of fintech can only be fully realized if its products and services are inclusive and accessible to everyone. By implementing a rigorous QA process that prioritizes accessibility and inclusivity, fintech companies can identify and address potential barriers to entry and create products and services that are usable and beneficial to a wider audience. Here are some steps that fintech companies can take to improve inclusion via QA for their apps:

Conduct User Research to understand the needs of different user groups, including those who may face barriers to financial inclusion. This can include people with disabilities, older adults, and people from low-income or marginalized communities.

Develop Inclusive Design Guidelines that outline best practices for creating accessible and inclusive financial/banking apps. These guidelines should cover areas such as user interface design, accessibility features, language and content.

Conduct Usability Testing with users from diverse backgrounds and abilities to identify any barriers to accessibility or inclusion. Use a range of assistive technologies, such as screen readers and magnifiers, to test the app’s accessibility features.

Test Security Features to ensure that they are accessible and easy to use for all users. This can include testing features such as two-factor authentication, password reset, and biometric authentication.

Ensure Compatibility with Assistive Technologies with a range of assistive technologies, such as screen readers, speech recognition software, and braille displays. Ensure that all content and features are accessible through these technologies.

Note! Many companies (including ours) pride themselves in testing new apps with flagman gadgets. Meanwhile, to increase inclusiveness, you need to have your hands on older models as well, and use them for testing as much as app’s OS allows it.

Conduct Localization Testing to ensure that the app is accessible for users who speak different languages or use different writing systems. Test the app’s language settings and ensure that all content is translated correctly.

Perform Accessibility Testing to ensure that the app meets the accessibility guidelines outlined in the inclusive design guidelines. Test for issues such as color contrast, font size, and alternative text for images.

By following these testing steps, banking and financial companies can ensure that their apps are accessible and inclusive for all users, regardless of their background or abilities.

Testing for Inclusion: Challenges and Solutions

If it was so easy, everyone would be doing it, right? So, let’s talk problems.

There are several real-life challenges that you may face when trying to implement testing for financial inclusion in fintech and banking solutions. These challenges include:

Limited resources

Problem: The limited number of testers, lack of specialized testing tools, and limited time and budget for testing.

Steps towards solution: Prioritize testing for financial inclusion and allocate resources accordingly. For many companies, testing that would improve inclusion is a blind spot. As an outsourcing company, we make it a rule to draw client’s attention to these matters. It is especially important when working on projects that target underserved communities, such as the Ebola Survey we helped to take to the doorstep in the furthest villages in Liberia.

Lack of expertise

Problem: Includes the lack of knowledge about accessibility guidelines and standards, and the lack of experience in conducting usability testing with diverse user groups.

Steps towards solution: provide training and education on inclusion and accessibility, as well as encourage ongoing learning and development among the QA team.

Limited access to diverse user groups

Problem: Conducting usability testing with diverse user groups is crucial for identifying and addressing accessibility issues. However, it can be challenging to access diverse user groups, especially those who are financially excluded.

Steps towards solution: Work with community organizations and non-profits that serve financially excluded populations to recruit user testers.

Complexity of financial products

Problem: Financial products can be complex, and testing for financial inclusion requires understanding the nuances of financial regulations, policies, and procedures.

Steps towards solution: Encourage your team to have a deeper understanding of the financial industry and work closely with product and development teams to ensure that testing is comprehensive and effective.

Balancing inclusion and other factors

Problem: While financial inclusion is important, it is also important to ensure that security and data privacy are not compromised, and financial goals are met.

Steps towards solution: Inclusive testing should be budgeted in advanced and intertwined with security team practices.

By recognizing these challenges and developing strategies to address them, QA teams can play a crucial role in improving financial inclusion in fintech and banking solutions.

Working on projects that promote diversity and help financial inclusion, we get more experienced in building sensitive testing strategies for fintech and banking solutions. Partnering with us, you get access to the QA and testing teams that are not only proficient, but also impact-driven and dedicated to quality for all.