No matter what software testing platform you’re going to choose for your project, banking and finance application testing is impossible to keep productive without one. By maintaining accurate project planning, linking different experts and teams together, and tracking the progress, a test management system basically becomes an integral part of your QA operations.

Leave room for future growth

They say a good plan makes the job half-done, and we couldn’t agree more, especially in the context of software testing for banking. The BFSI industry highly depends on IT, which creates pressure for software owners to keep up with the emerging tech trends so that their digital products would remain concurrent and interesting in the eyes of consumers. And while there’s no doubt in the importance of continuous digital transformation of banking applications, many product owners do not realize that unless you have planned for software scalability, it’s going to be extremely difficult to transform in the future.

Software scalability is the ability of a system to extend its functionality and capacity when needed. In other words, a scalable application allows software engineers to add new features to the existing codebase instead of starting over the development process only because they need some extra functions on board. Unfortunately, scalability is only achievable if planned early and implemented in the codebase on the architectural level. But how to find out if your banking application is going to be technically scalable? Of course, through early banking app testing.

Involving QA engineers to work on complicated projects like finance software as early as you can always pays back with better performance and saved resources. Usually, when people think of how to test banking applications, they imagine the process to follow as “develop first, test later”.

In reality though, if you want to end up with a future-proof digital solution with enough room for new functionality when needed, we strongly recommend adding prototype and requirements testing to your QA scope. By gathering expert opinions about what is planned to be built, you will be able to predict potential bottlenecks on the paper rather than urgently fix them before the release. With such a sensitive sector as finance management, early testing ensures a strong brand reputation and unwavering consumer trust.

Start looking for a way out from legacy solutions

Financial institutions are generally prone to bureaucracy that oftentimes holds them back from technological advancement. The thing is, in order to keep their internal operations running as safely as possible, banks and insurance entities cannot adopt IT change fast. That’s why the vast majority of modern banks are stuck with legacy operating systems and mainframe technologies that are just too huge and puzzling to transform, which may create additional challenges when you test banking domain applications. Generally, there’s nothing too bad about legacy systems as long as they work as required. But once you stumble across an emergency or just a new technology invented that your bank just can’t ignore, the legacy and mainframe systems might put at risk the functioning (if not the whole existence) of a bank.

A vivid example of such an emergency is the infamous COBOL crisis of 2020. In short, after the pandemic hit the fan, numerous US government departments experienced a huge increase in online unemployment claims. There were so many, that the mainframe system to process them simply could not stand the load. That mainframe system was based on COBOL (Common Business Oriented Language) ― a programming language created and widely used in the 1960s. It is outdated to the point that the majority of COBOL talent pool is now in their 70s, and the state had to ask for help from retired programmers to put the software back on track. It worked this time, luckily, but as the time goes by, next time there might be no such option available.

Is there a solution for finance establishments dependent on their legacy applications? We believe there is, even though the transformation path for such enterprises won’t be the easiest. If you don’t want to realize one day that your operating system is just a pile of fossils, we recommend you to set a solid QA process before the need for change actually comes into play. Again, the earlier software quality experts enter your SDLC, the less inaccuracies will make it to the end product. No digital product will benefit from QA supervision more than a large legacy solution that’s been developed for years. In this case, the duties of the software testing department are shifting to the strategic planning, code analysis, and prototyping from the usual pre-release testing, which is in fact just a small part of what quality assurance teams actually do.

Peculiarities of Banking Domain Testing

Banking application testing has a number of unique requirements that come from the critical nature of financial services, the high standards for reliability and security, and the extensive regulatory compliance demands. Further down, we’ll explore what the BFSI domain means and look at the key peculiarities of banking domain testing.

What is the BFSI domain in testing?

BFSI domain testing is a set of activities executed by software testing engineers to assure a banking application meets the technical requirements and works smoothly. Any operation aimed at achieving the higher software quality or fixing a glitch in a finance-related digital product falls into the BFSI domain testing. This means, the objectives for such an operation have to be aligned with the most important characteristics of a banking application. You may also consider adding a domain expert to your QA team to ensure that the application gets the best possible treatment.

Bank application testing: aspects to focus on

Banking software testing is not much different from any other type of quality assurance: it is still intended to check if the program works as expected and has no hidden bottlenecks drawing its potential back. However, the peculiarities of BFSI as an industry, namely ― data confidentiality and extreme sensitivity to thieving, make software development and testing teams shift their focus to particular areas that might not get as much attention with different types of software.

Banking software security testing

Financial applications directly interact with user confidential information and basically have all the keys to one’s capital, which means there is nothing more important than security for a banking app. QA engineers should devote proportionally more time to test the application for security, as well as include both negative and positive test scenarios of the app’s database being attacked. Only after the testing team can call the application fully hack-proof can it be considered market-ready (given that you got all the other aspects like performance and UI/UX covered as well).

Efficiency in use

Banking and finance sector has a huge share in IT services consumption, meaning there are millions of people who use at least one banking app on a daily basis. Understanding that not all users have equally strong technical skills, programs targeted at such a wide audience have to be very efficient and straightforward to be accepted by people. Make sure your banking app allows users to get things done fast and easy.

Domain coherence

The industry for which the software is created has more influence on the end product than many of us think. Different industries are run by different rules, and banking is no exception. It has its own terms, customs, and procedures which can cause confusion if not followed. Domain knowledge is important for developing finance or banking software, where product owners have to make sure the way their apps look and work corresponds to the generally accepted standards for both professionals and consumers. We recommend seeking domain-specific expertise for at least some roles in your R&D team. Ideally, the testing team you’re hiring has already worked with products targeted to the same industry, regardless of the app’s type and tech stack.

Scalability testing

As we already explained above, unscalable applications sooner or later will pull the rug out from under your business. This is why we can’t stress enough how important it is to keep the application’s architecture scalable and leave room for potential functionality growth since the very start. The QA team has to keep an eye on the app’s tech stack to pick modern technologies that will not lose its relevance in a few years and further, code implementation which has to be clear and reusable, and product structure to make sure it can increase in capacity without breaking down what’s already working. To test how scalable your application is going to be, a ton of tiny details have to be analyzed, from the app’s data processing algorithms to file system and memory management.

Accessibility in banking applications

As the World Health Organization reports, about a billion people in the world have at least one limitation ― physical or mental ― that affects their ability to use technology and software. This inspired software developers to pursue a higher level of accessibility for digital products. Considering how wide and diverse the target market of banking apps is, the accessibility issue should definitely be among the top priorities for owners of such products.

Mobile banking availability and compatibility

With close to 7 billion smartphones operated currently around the world and 212.8 million mobile banking users in the US alone, the mobile user segment is one that banks and financial institutions can no longer afford to ignore. Users expect to be able to access their bank account information and perform transactions at any time of the day while not having to worry about their sensitive information’s security.

This is why testing on mobile devices is just as important as testing on desktop platforms. That also involves comprehensive compatibility testing, as there are hundreds of smartphones out there and they all have their hardware and software peculiarities. This type of testing should ideally be performed on real devices, as there are many usability and user experience-related aspects of using an application that device emulators cannot replicate just yet.

Key Types of Banking Domain Application Testing

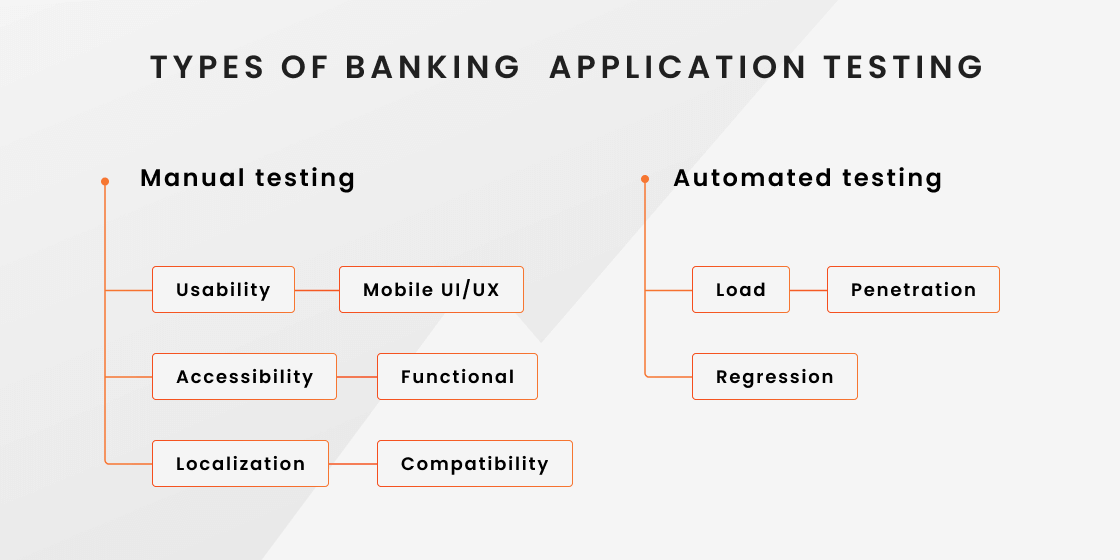

Banking applications are typically tested manually and automatically, using a range of testing types to ensure thorough coverage and address the unique challenges of the banking sector. Here’s a deeper look into the key types of banking domain application testing.

Manual banking app testing

Manual banking application testing implies that a quality assurance engineer executes certain test case scenarios by hand. This allows the development team to evaluate the product from human perspective and improve the subjective side of the application, intuitivity and aesthetics included.

Usability testing

Usability testing is pretty self-explanatory ― it examines how easy and comfortable it is to use a mobile or web application for different people. Usually, the process of usability testing consists of executing typical test scenarios the app was created for and documenting the issues representative users or manual testers stumble across during the execution, especially ones that are related to UI/UX design. The test cases should be realistic, like booking a flight for a customer-facing airport CRM or tracking an order for an online shop. Test case for banking application in this context could vary as follows:

- Log in with correct or incorrect credentials;

- Check card balance;

- Initiate a transaction to another account with valid or invalid data;

- Check the status of the transaction.

Mobile UI/UX testing for banking

Due to its sensory and technical peculiarities, mobile application testing differs a lot from desktop and web programs. Mobile banking testing is mostly centered on UI/UX because the basic functionality of such applications are not the easiest to reflect on a small screen. Furthermore, these days users want to be able to do anything on the go without compromising the safety of their personal information, which is another challenge to mitigate for UI/UX designers and testers. Test case scenarios for mobile UI/UX usually include:

- Testing the visual elements in terms of position, resolution, and size;

- Testing the pop-up windows and messages;

- Testing the readability of app’s content;

- Testing the alignment of the buttons, icons, and other elements;

- Testing the clickable elements for the comfort of use;

- Testing the different screen resolutions and sizes to see if the app looks appropriately on all devices that are planned to cover.

Accessibility testing

To achieve accessibility with your application, you need to incorporate and thoroughly test such features as font size customization, one-hand operation mode, screen reader, colorblind screen filter, etc. Testing of such features can be tricky since it’s only people living with a certain limitation who can tell if the app is doing a good job. If possible, we’d recommend considering a focus group for accessibility testing or at least launching a beta to gather the feedback and implement the necessary changes. Specifically for the finance and banking apps, we suggest the following addings to make your product more accessible:

- Solid first-launch tutorial to introduce new users to your application;

- Incorporate speech recognition technology;

- Closed captioning and subtitling for low-hearing users;

- Touch screen and/or gesture alternative for people with sensory limitations;

- Contrast and color options for users with compromised vision.

Bank software functional testing

A typical banking application has a wide range of features, and the job of the testing team is to make sure they are all present and operate properly in the release version of the product. Functionality testing means a QA engineer defines the core functions of an application and then tests them one by one in different scenarios. Composing a testing scenario is an integral part of a QA’s job. The output received after the test cases execution gets compared to what was expected and fixed if needed. Bank software functional testing helps engineers focus on the following:

- The time needed for the application to launch;

- Registration of a new user;

- Login of an existing user;

- Transactions and cash withdrawal;

- Cancellation of a transaction;

- Communication with technical support in the app;

- Session finalization with a corresponding warning message;

- Notifications and pop-ups.

Localization testing

The purpose of localization is to ensure that the content displayed in the application fits the region it is intended to launch in. Due to the cultural differences across countries, the look of the app at times requires drastic changes. Localization testing also ensures that the application complies with local laws and regulations, so it usually goes deeper than just language and timezone settings. Online-banking tests for localization include:

- Different default currency for each region;

- Time and date change according to the location;

- Marketing campaigns adjustment (like congratulatory messages regarding the local holidays);

- Translation and switchable multi-language interfaces;

- Adherence to the local regulations regarding the finance and tax monitoring.

Compatibility testing

Compatibility testing stands for the analysis of how your application works with different operating systems, network environments, and hardware models. Nowadays, this is a very important type of testing due to the fact that the IT industry develops at a very fast pace. Versions of operating systems change one another every year, let alone the minor updates we all receive on our gadgets regularly without even noticing this anymore. However, even the slightest technical change like another Android security patch can interfere with the functioning of your app. To test the compatibility of a banking application, software testers usually focus on these specifications:

- Networks: Wi-Fi, 5G, etc.

- Operating systems, web and mobile: Mac, Windows, Linux, iOS, and Android with defined versions and updates.

- Hardware generations: for example, iPhone 6 to 15.

- Web browsers: Safari, Google Chrome, Microsoft Edge, Firefox, Opera.

Automated testing

Automated testing is a method of software quality assurance that implies test cases execution with the use of automated testing tools, as opposed to manual testing. To enable testing automation, the team has to come up with the expected outcome for each test case that a program will then compare to the real result received after the execution. This method of quality assurance perfectly suits routine and continuous types of testing that have strictly defined outcomes (for example, pass/fail criteria or similar). Some types of testing — for example, user acceptance testing — can hardly be automated. However, for many other types, including database testing and integration testing, automation works wonders.

Bank software load testing

Load and performance testing examines the work of an application under different levels of load, from low to average and extremely high. It allows QA departments to prevent application shutdowns because of rapid increase in traffic, as with the HSBC mobile app we mentioned above. This type of testing falls under the automation category perfectly, because the typical QA flow with performance and load consists of numerous very similar test cases that differ only in the level of user sessions, requests, or, in our case, banking transactions. To successfully automate bank software load testing, the QA team has to:

- Identify critical actions that your application has to perform;

- Write test cases basing in these critical actions;

- Identify the strict fail/pass outcome for each test case;

- Create isolated test environment that would be free of any traffic other than the results of your load testing;

- Let the system execute the test cases and analyze the results.

Penetration testing

Penetration testing is basically just another name for security testing, which means it checks how safe and solid your system is and whether it’s possible to hack it. Its importance comes from the fact that banking applications handle all kinds of sensitive information, which means there is no room for error.

The key objective of penetration testing is to discover weaknesses in the application database, as well as explore app’s reaction to unauthorized access attempts. Since the essence of penetration testing is a simulated attack, it can also be easily automated with software testing tools without compromising the accuracy of results. For banking application penetration testing, the test cases usually include the following:

- Track data transpassed by the application;

- Check if any sensitive information is exposed in URLs, binary files, etc.

- Identify insecure functions;

- Check the application’s reaction to spam attacks;

- Monitor proxy server traffic;

- Exploit all application’s databases and systems.

Banks must undertake penetration testing for both their system and the architecture and get a formal Certificate, confirming that it has been conducted. Typically, they need to do this every 6-12 months. If they implement any fundamental changes to their software or hardware, they also need to ensure that it still complies with industry regulations.